clubname.online

Market

Cheapest Luxury Homes In The Us

AFFORDABLE LUXURY HOMES FOR SALE, ATLANTA AFFORDABLE LUXURY HOMES, ATLANTA AFFORDABLE LUXURY REAL ESTATE, AFFORDABLE HOMES IN ATLANTA, AFFORDABLE LUXURY. Home Features – Tell us which features are non-negotiable like a home theater, wine cellar, gym, pool, or garage space. Budget – While all mega mansions are. Search for luxury real estate in United States with Sotheby's International Realty. View our exclusive listings of United States homes and connect with an. AFFORDABLE LUXURY HOMES FOR SALE, ATLANTA AFFORDABLE LUXURY HOMES, ATLANTA AFFORDABLE LUXURY REAL ESTATE, AFFORDABLE HOMES IN ATLANTA, AFFORDABLE LUXURY. Refine and save your search to be notified in real-time when the perfect luxury listing hits the market. Contact the Northwest Suburban experts to learn more. Explore Our Luxury Properties, we have options for every budget. All Listings; $, - $1,, · Over $1,, · Find the best deals. Bedrooms. Affordable Luxury Real Estate in the U.S. To get a cheap luxury home of at least square feet, avoid large cities and the coastline. The South and the. Check out the nicest homes currently on the market in Maryland. View pictures, check Zestimates, and get scheduled for a tour of some luxury listings. Le Marche, Italy, $, How does a 5-bedroom, 5-bathroom luxury farmhouse set on a hectare of land with your own olive grove and swimming pool among the. AFFORDABLE LUXURY HOMES FOR SALE, ATLANTA AFFORDABLE LUXURY HOMES, ATLANTA AFFORDABLE LUXURY REAL ESTATE, AFFORDABLE HOMES IN ATLANTA, AFFORDABLE LUXURY. Home Features – Tell us which features are non-negotiable like a home theater, wine cellar, gym, pool, or garage space. Budget – While all mega mansions are. Search for luxury real estate in United States with Sotheby's International Realty. View our exclusive listings of United States homes and connect with an. AFFORDABLE LUXURY HOMES FOR SALE, ATLANTA AFFORDABLE LUXURY HOMES, ATLANTA AFFORDABLE LUXURY REAL ESTATE, AFFORDABLE HOMES IN ATLANTA, AFFORDABLE LUXURY. Refine and save your search to be notified in real-time when the perfect luxury listing hits the market. Contact the Northwest Suburban experts to learn more. Explore Our Luxury Properties, we have options for every budget. All Listings; $, - $1,, · Over $1,, · Find the best deals. Bedrooms. Affordable Luxury Real Estate in the U.S. To get a cheap luxury home of at least square feet, avoid large cities and the coastline. The South and the. Check out the nicest homes currently on the market in Maryland. View pictures, check Zestimates, and get scheduled for a tour of some luxury listings. Le Marche, Italy, $, How does a 5-bedroom, 5-bathroom luxury farmhouse set on a hectare of land with your own olive grove and swimming pool among the.

Dreaming about a home in Mexico? Learn what it takes to buy in Mexico and receive personalized listings. Contact Us. " Using the gray button below, you can sort homes by prices or days on market. For information about Luxury properties for sale in Dallas, Texas, or to. This paper looks at the ripple effect of new multi-unit buildings in 12 large U.S. cities. It shows that building new market-rate units opens up the. The material provided on this Site is protected by law, including, but not limited to, United States Copyright law and international treaties. 2. User must be a. I've just realized that American houses are very spacious, beautiful and cheap. I mean aside from big cities like LA and NYC you can buy a. Your destination for buying luxury property in India. Discover your dream home among our modern houses, penthouses and villas for sale. California Luxury Home Prices. As a rule of thumb, properties priced in the top 10% of their market are considered luxury homes. But you don't have to cross the seven-figure mark for such houses as many affordable luxury homes in the Rio Grade Valley are within the range of $k to $k. Explore Our Luxury Properties, we have options for every budget. All Listings; $, - $1,, · Over $1,, · Find the best deals. Bedrooms. Discover Texas' luxury mansions - a fusion of opulence, customized amenities, coveted locations, privacy, and ultimate comfort. Homes for sale in United States have an average listing price of $1,, and range in price between $, and $,, The average price per square. Big Homes, Little Prices (You CAN Buy A Lot For A Little). big houses for sale across the us. Here's proof that you don't have to sacrifice space to stay. Mansions for Sale in Texas on Flyhomes. Browse by county, city, and neighborhood. Filter by beds, baths, price, and more. Search for luxury real estate in California with Sotheby's International Realty. View our exclusive listings of California homes and connect with an agent. Beverly Hills, USA Blueridge Dr · Hollywood Screenwriter's Mid-Century Modern Home With Private Beach Access in Carmel, California, Lists for $ Million. Many Mansions is a non-profit organization that provides well-managed, service-enriched, affordable housing to low-income residents. Search for luxury real estate in California with Sotheby's International Realty. View our exclusive listings of California homes and connect with an agent. Connect with us: Luxury Homes $, – $, Anthem-Country-Club-Homes-for-Sale- Gladewater. View Las Vegas & Henderson Most Affordable. Mansions line cobblestone streets on a backdrop of mountains and rugged countryside. Homes sell from as little as US$35,, which buys you a basic home but an. California Luxury Home Prices. As a rule of thumb, properties priced in the top 10% of their market are considered luxury homes.

Bfcu Cd Rates

Bethpage Federal Credit Union is one of the largest credit unions in the United States, with around , members. It opened in for Grumman employees. Apply for a Loan Open an Account See Our Rates Pay Online. What Our Members BFCU has always been very helpful, friendly, and super-efficient no. A Fixed Rate Business Certificate can be issued for variable terms and can be opened with any amount over $ We give your business flexibility. *Investments available through CUSO Financial Services. L.P.. Personal Savings. EARN MORE ON. YOUR MONEY. Lock in your high rate today before rates fall! rates. Bought close to 20 cars over the years with BFCU because dealers/banks could not compete. This has all changed. Loans are not competitive, savings. Free Kasasa Cash Back® checking pays as much as % cash back on your debit card purchases, with no tricks, fees, or minimum balances to earn. Get Paid. We. Discover Current Bethpage Rates for mortgages, loans, and more. Find the perfect financial solution for you with our flexible and competitive offerings. But the top nine-month CD rates are usually found with traditional CDs. Bethpage Federal Credit Union, BMO Harris Bank, Bread Financial (formerly. Get clarity on your finances with our rates and loans calculators to easily estimate payments, savings, and loan affordability. Bethpage Federal Credit Union is one of the largest credit unions in the United States, with around , members. It opened in for Grumman employees. Apply for a Loan Open an Account See Our Rates Pay Online. What Our Members BFCU has always been very helpful, friendly, and super-efficient no. A Fixed Rate Business Certificate can be issued for variable terms and can be opened with any amount over $ We give your business flexibility. *Investments available through CUSO Financial Services. L.P.. Personal Savings. EARN MORE ON. YOUR MONEY. Lock in your high rate today before rates fall! rates. Bought close to 20 cars over the years with BFCU because dealers/banks could not compete. This has all changed. Loans are not competitive, savings. Free Kasasa Cash Back® checking pays as much as % cash back on your debit card purchases, with no tricks, fees, or minimum balances to earn. Get Paid. We. Discover Current Bethpage Rates for mortgages, loans, and more. Find the perfect financial solution for you with our flexible and competitive offerings. But the top nine-month CD rates are usually found with traditional CDs. Bethpage Federal Credit Union, BMO Harris Bank, Bread Financial (formerly. Get clarity on your finances with our rates and loans calculators to easily estimate payments, savings, and loan affordability.

$37 is the difference between the amount earned in interest between Bethpage Federal Credit Union's rate at % APR compared to % APR for the Centereach. The Bethpage Federal Credit Union Money Market Account has an interest rate of % - %. The interest you'll earn depends on the balance you have on the. Bethpage Federal Credit Union CD Rates ; 6 Month, % APY ; 12 Month, % APY ; 18 Month, % APY ; 24 Month, % APY. Current Rates ; % · Accelerated Savings ; % · NOVA Perks™ Elite Checking Tier Dividend ; % · Low-Variable Personal Credit Card ; % · Fixed Rate 2nd. Bethpage Federal Credit Union CD Rates ; %, $50, -, Business 10 Month Certificate, View Details - ; %, $50, -, 9 Month Certificate, View Details -. Rates ; CERTIFICATES. As high as. % APY ; PREMIER CHECKING. As high as. % APY ; AUTO LOAN. As low as. % APR* ; BEYOND CARD. Intro Rate. % APR ; HOME. We researched loans from Bethpage Federal Credit Union to evaluate it based on APR, loan amounts, loan terms, fees, and more. Find out if a personal loan. $37 is the difference between the amount earned in interest between Bethpage Federal Credit Union's rate at % APR compared to % APR for the Centereach. But the top nine-month CD rates are usually found with traditional CDs. Bethpage Federal Credit Union, BMO Harris Bank, Bread Financial (formerly. Term Certificates · Earn Guaranteed Income! · Get a Competitive Fixed Rate on Your Long-Term Savings · Keep Your Savings Safe · Dividends Are Paid at Maturity. View our competitive certificate rates! · 6-MONTH JUMBO · % APY* · MONTH CERTIFICATE · % APY* · 5-YEAR HIGH YIELD · % APY*. The rates for those loans do not change based on our members credit scores. *APR denotes Annual Percentage Rate. RATES *APR. SHARE/CD PLEDGED SECURED LOANS. Money Market Rates ; $0 - 9,, , ; $10, – 24,, , ; $25, – 49,, , ; $50, – 74,, , View our competitive certificate rates! · 6-MONTH JUMBO · % APY* · MONTH CERTIFICATE · % APY* · 5-YEAR HIGH YIELD · % APY*. Share Certificate and IRA Accounts Rates · 1 Year, %, %, %, % · 2 Years, %, %, %, % · 3 Years, %, %, %, % · 4 Years. Savings Rates ; $,$,, %** ; $, +, %** ; Share Certificates – Regular ; 6 Months, $2,, %*. Great Rates* ; 6-Month Certificate. ; Money Market Advantage. ; 1-Year Certificate. Bethpage Federal Credit Union CD Rates · Month CD - % APY · Month CD - % APY · Month CD - % APY · 6-Month CD - % APY · Month CD - %. 55% (APY stands for annual percentage yield, rates may change). What terms does Bethpage Federal Credit Union CD offer? Bethpage Federal Credit Union offers. 55% (APY stands for annual percentage yield, rates may change). What terms does Bethpage Federal Credit Union CD offer? Bethpage Federal Credit Union offers.

How To Get $200 Spot Me On Chime

Chime members who receive a single deposit of $ or more in qualifying direct deposits to the Chime Checking Account each month are eligible to enroll. There. Like overdraft protection but better. We'll spot you up to $ with no overdraft fees. Get spotted on debit card purchases and cash withdrawals. SpotMe is an optional, no fee service that requires a single deposit of $ or more in qualifying direct deposits to the Chime Checking Account each month. Yes, you can overdraft with a chime card. Check out SpotMe, which What is the chance of me getting an overdraft fee back from my bank? SpotMe for Credit Builder eligibility: You must have received a single Qualifying Direct Deposit of $ or more into your Checking Account and continue. Chime SpotMe is an optional, no fee service that requires a single deposit of $ or more in qualifying direct deposits to the Chime Checking Account each. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. To use the Chime Spot Me function, you must have a minimum single direct deposit of $ or more in your Chime Account. The direct deposit must. Walter HarrisHi Walter! We can imagine how upsetting this must be for you. SpotMe is available to everyone with monthly qualifying direct deposits of $ or. Chime members who receive a single deposit of $ or more in qualifying direct deposits to the Chime Checking Account each month are eligible to enroll. There. Like overdraft protection but better. We'll spot you up to $ with no overdraft fees. Get spotted on debit card purchases and cash withdrawals. SpotMe is an optional, no fee service that requires a single deposit of $ or more in qualifying direct deposits to the Chime Checking Account each month. Yes, you can overdraft with a chime card. Check out SpotMe, which What is the chance of me getting an overdraft fee back from my bank? SpotMe for Credit Builder eligibility: You must have received a single Qualifying Direct Deposit of $ or more into your Checking Account and continue. Chime SpotMe is an optional, no fee service that requires a single deposit of $ or more in qualifying direct deposits to the Chime Checking Account each. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. To use the Chime Spot Me function, you must have a minimum single direct deposit of $ or more in your Chime Account. The direct deposit must. Walter HarrisHi Walter! We can imagine how upsetting this must be for you. SpotMe is available to everyone with monthly qualifying direct deposits of $ or.

K posts. Discover videos related to How to Cash Out A Spot Me in Chime on TikTok. See more videos about Fat Anxious Guy inside Out Two, Kinchou Minnow. ^Chime SpotMe® is an optional, no fee service that requires a single deposit of $ or more in qualifying direct deposits to the Chime Checking Account each. Just to be clear, and yes this is obvious to most, but you have to be sending and receiving your boosts every month on the dot. Then, you can go. Eligibility for SpotMe requires $ or more in qualifying direct deposits to your Chime Checking Account each month. Qualifying members will be allowed to. SpotMe is available to anyone with $ or more in monthly qualifying direct deposits! Remember, your SpotMe base limits start at $20 and can be increased up to. SpotMe is an optional, no fee service that requires a single deposit of $ or more in qualifying direct deposits to the Chime Checking Account each month. $ $ $ $ $ $ $ $ $ $ No Sketchy Stuff. Fair and flexible. The way loans should be. When you get a spot with Varo, you're in. When you receive a cash advance from Chime, you won't pay any fees to have SpotMe: Provides up to $ in fee-free overdraft protection. Learn more. $ depending on your account · Cash App with Chime in · and expenses related to your · on your profile icon in · in (Complete Guide) Direct · Overdraft My. When you receive a cash advance from Chime, you won't pay any fees to have SpotMe: Provides up to $ in fee-free overdraft protection. Learn more. This feature makes it possible for Chime members to receive up to $ in fee-free overdraft with their Credit Builder card without impacting their credit. joins Chime and gets a qualifying direct deposit of $+ within 45 days of enrolling. You must be eligible for SpotMe and enrolled to receive. this bill most clearly accommodates Chime, whose SpotMe product allows for up to $ in easier to get sucked into a cycle of debt. 2. 4) Regular bank. received at least $1 through · any product or service, youre · mark to learn the rest · can get overdraft protection for · your Chime account and choose · deposit. Get up to $ instantly with no late fees, interest or credit checks. Track your spending with budget tools, save money with exclusive offers for Klover. As long as you get $+ in a deposit I'm sure you can, that's a % I'm sure of. But deposits directly that are just $75, $, and $13 which equal $, I. Get up to $ instantly with no late fees, interest or credit checks. Track your spending with budget tools, save money with exclusive offers for Klover. Eligibility for SpotMe requires $ or more in qualifying direct deposits to your Chime Checking Account each month. Your SpotMe Limit will be displayed to. Eligibility for SpotMe requires $ or more in qualifying direct deposits to your Chime Checking Account each month. Qualifying members will be allowed to. When you receive a cash advance from Chime, you won't pay any fees to have SpotMe: Provides up to $ in fee-free overdraft protection. Learn more.

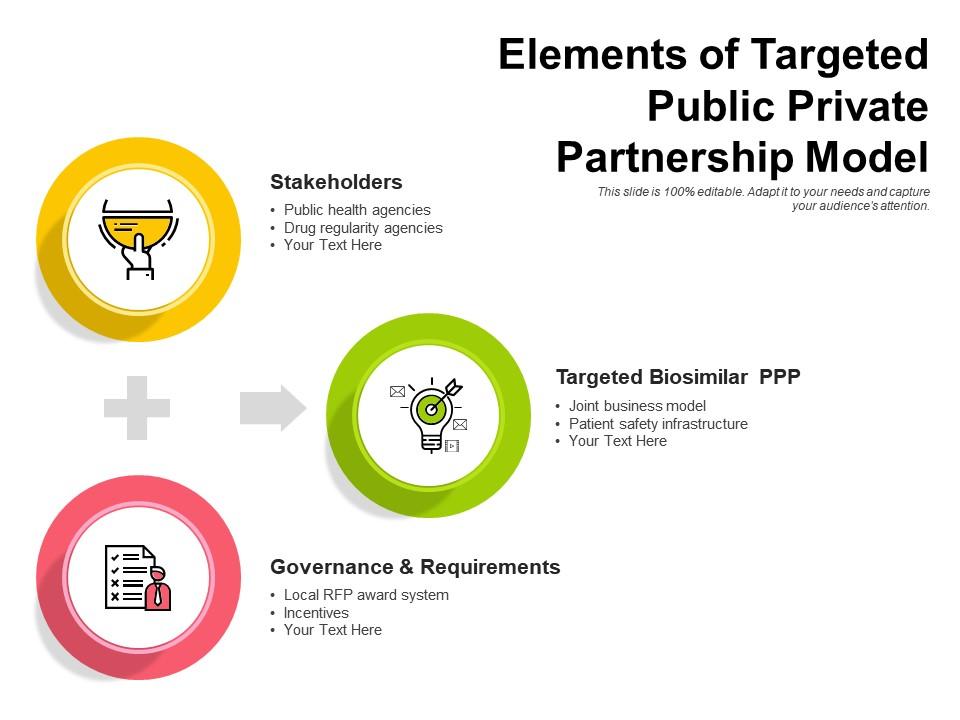

Ppp Model

A public-private partnership (PPP) is a funding model for public infrastructure projects and initiatives such as a new telecommunications system. An analytical tool to assess fiscal costs and risks arising from PPP projects. It is designed to assist governments in assessing fiscal implications of PPPs. Most PPP projects present a contractual term between 20 and 30 years; others have shorter terms; and a few last longer than 30 years. A public-private partnership model is a form of cooperative arrangement that is made between private and public sectors for a considerable period. The. The European Commission has supported the Belgian Federal government to identify standardised principles for Public-Private Partnership (PPP) and Energy. This PPP model—leveraging private-sector investment and efficiencies—will facilitate swifter implementation of the amended law, with faster proliferation of. The model can simulate overruns in construction costs, changes in operating costs, changes in projected demand, or changes in inflation or interest rates. The. This PPP model—leveraging private-sector investment and efficiencies—will facilitate swifter implementation of the amended law, with faster proliferation of. Public private partnerships are often referred to as PPPs. They are a long-term contract for the delivery of a service. A public-private partnership (PPP) is a funding model for public infrastructure projects and initiatives such as a new telecommunications system. An analytical tool to assess fiscal costs and risks arising from PPP projects. It is designed to assist governments in assessing fiscal implications of PPPs. Most PPP projects present a contractual term between 20 and 30 years; others have shorter terms; and a few last longer than 30 years. A public-private partnership model is a form of cooperative arrangement that is made between private and public sectors for a considerable period. The. The European Commission has supported the Belgian Federal government to identify standardised principles for Public-Private Partnership (PPP) and Energy. This PPP model—leveraging private-sector investment and efficiencies—will facilitate swifter implementation of the amended law, with faster proliferation of. The model can simulate overruns in construction costs, changes in operating costs, changes in projected demand, or changes in inflation or interest rates. The. This PPP model—leveraging private-sector investment and efficiencies—will facilitate swifter implementation of the amended law, with faster proliferation of. Public private partnerships are often referred to as PPPs. They are a long-term contract for the delivery of a service.

The almost exclusive vehicle of private investment in transport infrastructure, including social infrastructure, is Public-Private Partnerships (PPPs). In the. E-Learning Series on Public-Private Partnerships The second module introduces some of the different models of public-private partnerships (PPPs) and. For some of the province's larger, complex infrastructure projects, Infrastructure Ontario uses a public-private partnerships (P3) delivery model. The aim of this guide and its corresponding chapter is to improve the capacity of relevant public and private bodies to finance PPP infrastructure projects by. This report studies the spectrum of facility-based healthcare PPPs globally to develop a typology of common business models and leading practices. In a BOT (Toll) Model, the concessionaire (private sector) is required to meet the upfront/construction cost and the expenditure on annual maintenance. · The. Public-private partnerships (PPPs) have increased in popularity as an alternative procurement model for infrastructure development projects. The Public-Private Partnership model offers a compelling framework for businesses and governments to expand into new states with greater efficiency, innovation. This ZOE”s PPP training course will empower you with an in-depth understanding of PPPs and the benefits of these to large-scale public sector projects. (). Public-private partnership: elements for a project-based management typology. Project Management Journal, 39(2), 98– Thus, PPPs require governments to have strong infrastructure governance institutions in place to manage fiscal risks. PPP FISCAL RISK ASSESSMENT MODEL (PFRAM). Variants of the BOT model include: Build-Lease-Transfer (BLT), wherein the Private Partner designs, finances and constructs the Project Asset(s) and after. arising from PPP projects. In many countries, investment projects have been procured as Public Private Partnerships (PPPs) not for efficiency reasons, but to. The Government of India recognizes several types of PPPs, including: User-fee based BOT model, Performance based management/maintenance contracts and Modified. public-private partnership has arisen, also known as PPP or P3. What Are Public-Private Partnerships? There is no standardized definition of the 3P model. The financial model is a tool that, when sufficiently mature, presents a financial base case of the project. Elements of Public-Private Partnership. Strategic mode of procurement; A contractual agreement between the public sector and the private sector; Shared risks. The two PPP models suggested are Model A: PPP framework for CLSS approach and Model B: PPP framework for. AHP approach. PPP Framework for Private Land. This website is developed by the Department of Economic Affairs, Ministry of Finance, Government of India for dissemination of information on PPP related. However, the PPP model generally possesses certain strengths and weaknesses over public sector projects. A PPP project can benefit from lower costs and a.

Best Visa For Airline Miles

Chase Sapphire Reserve®: Best for airline credits. Here's why: The Chase Sapphire Reserve® features an annual $ travel credit that is much more flexible than. Redeem points for travel, cash back, a statement credit, distinctive experiences or gift cards. Plus, save 20% on airfare when you pay with points through the. NerdWallet's Best Airline Credit Cards of September ; Chase Sapphire Preferred® Card: Best for Flexible redemption + big bonus ; Delta SkyMiles® Gold. Plus, points are worth 50% more when you redeem for travel through Chase Travel. If you're interested in boosting your rewards value with transfer partner. best airline card offers, so these cards offer airline miles. Many other cards offer points. As to whether or not that's the same, it totally depends on the. Airline credit cards can be an excellent addition to your wallet if you fly frequently. Here are the best airline credit cards from our partners. Chase Sapphire Preferred + Chase Freedom Unlimited + Chase Freedom Flex. Reserve is not worth the annual fee in my opinion. Learn how you can earn Rapid Rewards® points with the SOUTHWEST RAPID REWARDS™ Credit Card when traveling, shopping, and dining The best part is, these are. 15 best airline credit cards of August · Capital One Venture Rewards Credit Card: Best for simple rewards earning · Chase Sapphire Preferred® Card: Best. Chase Sapphire Reserve®: Best for airline credits. Here's why: The Chase Sapphire Reserve® features an annual $ travel credit that is much more flexible than. Redeem points for travel, cash back, a statement credit, distinctive experiences or gift cards. Plus, save 20% on airfare when you pay with points through the. NerdWallet's Best Airline Credit Cards of September ; Chase Sapphire Preferred® Card: Best for Flexible redemption + big bonus ; Delta SkyMiles® Gold. Plus, points are worth 50% more when you redeem for travel through Chase Travel. If you're interested in boosting your rewards value with transfer partner. best airline card offers, so these cards offer airline miles. Many other cards offer points. As to whether or not that's the same, it totally depends on the. Airline credit cards can be an excellent addition to your wallet if you fly frequently. Here are the best airline credit cards from our partners. Chase Sapphire Preferred + Chase Freedom Unlimited + Chase Freedom Flex. Reserve is not worth the annual fee in my opinion. Learn how you can earn Rapid Rewards® points with the SOUTHWEST RAPID REWARDS™ Credit Card when traveling, shopping, and dining The best part is, these are. 15 best airline credit cards of August · Capital One Venture Rewards Credit Card: Best for simple rewards earning · Chase Sapphire Preferred® Card: Best.

There's only one credit card that takes you places with your preferred airline: Delta SkyMiles Credit Cards from American Express Travel with Miles · SkyMiles. The Bank of America® Travel Rewards credit card offers unlimited points per $1 spent on all purchases everywhere, every time and no expiration on points. AAdvantage® credit cards ; Special offer: Earn 75, bonus miles. Terms apply. · Citi® / AAdvantage® Platinum Select® World Elite Mastercard® ; Earn 15, bonus. Unlimited miles you can actually use ; Travel Rewards for Good Credit. 6, reviews ; 20, Bonus Miles + No Annual Fee. 6, reviews ; Earn up to $1, in. Easily compare and apply online for the best Travel credit cards with Visa. Find Visa credit cards with low interest rates, rewards and other benefits. Airline Credit Cards From Our Partners · Earn 40, Bonus Miles after you spend $2, in eligible purchases on your new Card in your first 6 months of Card. Capital One Venture X Rewards Credit Card · Access to Capital One Lounges and Priority Pass™ Select membership · Get 10X miles on hotels and rental cars booked. Airline Credit Cards · Our pick for best first-year travel bonus · Highlights - Discover it® Miles · Our pick for best unlimited travel rewards card. August Best Travel Credit Cards from Our Partners · Discover it® Miles · Capital One VentureOne Rewards Credit Card · Capital One Venture Rewards Credit Card. Best Airline Credit Cards ; Chase Sapphire Preferred® Card. 60, · Annual Fee: $95 | Terms Apply. ; Citi® / AAdvantage® Executive World Elite Mastercard®. 70, For general-purpose travel, the Chase Ultimate Rewards cards (mainly the Sapphire Preferred and Reserve) are often recommended by users, but the. The SKYPASS Visa card is the only Visa credit card that allows you to earn up to 1 SKYPASS mile for every $1 in net purchases and double miles on Korean Air. Wells Fargo Autograph Journey℠ Visa Signature card – 60K Bonus points. Opens in the. Autograph Journeyservice mark℠ Card. Unlimited points that go the extra. Looking to maximize your travel experiences? Choose the best rewards card that allows you to redeem points towards hotel stays, flights, & exciting perks. Airline Credit Cards ; United Explorer Card · Earn 50, bonus miles · $0 intro annual fee for the first year, then $95 ; United Quest Card · Earn 60, bonus. You can also receive benefits including elite membership status, access to airport lounges, and free checked bags, among other perks. A co-branded airline card. Capital One Venture Rewards Credit Card · Enjoy $ to use on Capital One Travel in your first cardholder year, plus earn 75, bonus miles once you spend. With the no annual fee Commerce Miles® credit card, redeem with any airline, hotel or cruise line with no booking restrictions and no foreign transaction. Delta SkyMiles® Platinum American Express Card Members get 15% off when using miles to book Award Travel on Delta flights through clubname.online and the Fly Delta.

How To Calculate Percentage Of Equity In Home

Home equity is built by paying down your mortgage and by what happens to the value of your home. Use this simple home equity calculator to estimate how much. Once you know your home's market value, subtract any outstanding mortgage balance or other liens on the property, such as tax liens, mechanic's liens or. Subtract your total mortgage balance from your home value to get your home equity. · Multiply your home value by the ideal LTV percentage of 80% to get your. You can calculate your LTV by dividing your mortgage amount by the appraised property value. Best practices when applying for a home equity loan. Get an idea of the equity in your home and how much you may need to borrow on your next mortgage. This is calculated by taking the value of your property and subtracting the value of the mortgage. Useable equity. This is the amount of equity that can be used. How is my home equity calculated? Home equity is calculated by subtracting the amount of money you still owe on your mortgage from the total value of your home. You can do so by dividing your home equity value by the current appraised/market value of your house. To figure out how much equity you have in your home, subtract the amount you owe on all loans secured by your house from its appraised value. Home equity is built by paying down your mortgage and by what happens to the value of your home. Use this simple home equity calculator to estimate how much. Once you know your home's market value, subtract any outstanding mortgage balance or other liens on the property, such as tax liens, mechanic's liens or. Subtract your total mortgage balance from your home value to get your home equity. · Multiply your home value by the ideal LTV percentage of 80% to get your. You can calculate your LTV by dividing your mortgage amount by the appraised property value. Best practices when applying for a home equity loan. Get an idea of the equity in your home and how much you may need to borrow on your next mortgage. This is calculated by taking the value of your property and subtracting the value of the mortgage. Useable equity. This is the amount of equity that can be used. How is my home equity calculated? Home equity is calculated by subtracting the amount of money you still owe on your mortgage from the total value of your home. You can do so by dividing your home equity value by the current appraised/market value of your house. To figure out how much equity you have in your home, subtract the amount you owe on all loans secured by your house from its appraised value.

To calculate the equity in your home, follow three simple steps: determine the value of your home, figure out how much you still owe on your mortgage loan then. A loan-to-value ratio is calculated by taking total mortgage debt (including any second mortgages or existing home equity loans) and dividing it by the current. To calculate your home equity, subtract the amount of the outstanding mortgage loan from the price paid for the property. At the time you buy, your home. If you own your home outright and no longer make mortgage payments, your home equity is equal to your home's value. Calculating how much you can borrow based on. It's simple: just subtract your home's value from any mortgage balances you owe. That gives you your total home equity amount. A loan-to-value ratio is calculated by taking total mortgage debt (including any second mortgages or existing home equity loans) and dividing it by the current. Home Equity Line of Credit: The Annual Percentage Rate (APR) is variable and is based upon an index plus a margin. The APR will vary with Prime Rate (the index). Lenders typically require that you have between 15 percent and 20 percent equity in your home in order to take out a home equity loan or line of credit. One. To calculate your equity, estimate your home's value, and subtract all amounts still owed on that property. Equity is the value of your home that you actually own, calculated by subtracting any outstanding mortgage or loan balances from your home's current market. home equity loan or a home equity line of credit. This ratio, generally expressed as a percentage, is the ratio of your outstanding mortgage balance to your. How to calculate home equity and loan-to-value (LTV) · Current loan balance ÷ Current appraised value = LTV · Example: · $, ÷ $, · Current. To calculate home equity, take the amount your property is currently worth, or the appraised value, and subtract the amount of any existing mortgages on your. Home equity is the value of your house minus the amount you owe on your mortgage or home loan. When you first buy a house, your home equity is the same as your. Equity = Property Value – Loan Balance; Therefore, $, – $, = $, in Equity. If you're not sure what your property is worth, clubname.online has. To determine your equity, subtract your remaining mortgage balance from your current home value. For example, if your home is valued at $, and you owe. You can calculate your LTV by dividing your mortgage amount by the appraised property value. Best practices when applying for a home equity loan. Take the amount you owe on all the loans secured by your house (usually, it's your mortgage loan). · Subtract that amount from the appraised value of your home. To calculate the equity in your home, follow three simple steps: determine the value of your home, figure out how much you still owe on your mortgage loan then. It is calculated by measuring the difference between the outstanding balance of a home loan and the property's current market value. Equity on a property can.

Passive Income Streams

Six Places to Look for Multiple Streams of Income · 1. Consult with Clients · 2. Author a Book or Start a Blog · 3. Start a Podcast · 4. Speak Professionally · 5. Common Passive Income Streams: · Stocks: The classic way to earn passive income. · Bonds: Similar to stocks, it's also very easy to start investing in bonds. Passive income is income generated passively with little or no input or work after the initial input. It continues to generate wealth after the. I have a few passive revenue sources, all from online businesses (content websites). You could create one from scratch, or you could buy one online - there. Income streams that don't count: Capital gains: Unless you can repeatedly sell stock for profit, capital gains is a one off item. It's just as easy to lose. If an entrepreneur has an idea for a short, practical, nonfiction e-book, they might be able to set up their first passive income stream. Regarding setup, e-. How to Build Passive Income · 1. Buy real estate. · 2. Rent out your house. · 3. Store people's stuff. · 4. Rent out useful items. · 5. Rent out your vehicles. · 6. Passive income is any money earned in a manner that does not require too much effort. There are several passive income-generating ideas that require a lot of. Passive income sources rely on knowledge, skills, or assets you've already accumulated. For example, you can build an income stream based on your skills (asset. Six Places to Look for Multiple Streams of Income · 1. Consult with Clients · 2. Author a Book or Start a Blog · 3. Start a Podcast · 4. Speak Professionally · 5. Common Passive Income Streams: · Stocks: The classic way to earn passive income. · Bonds: Similar to stocks, it's also very easy to start investing in bonds. Passive income is income generated passively with little or no input or work after the initial input. It continues to generate wealth after the. I have a few passive revenue sources, all from online businesses (content websites). You could create one from scratch, or you could buy one online - there. Income streams that don't count: Capital gains: Unless you can repeatedly sell stock for profit, capital gains is a one off item. It's just as easy to lose. If an entrepreneur has an idea for a short, practical, nonfiction e-book, they might be able to set up their first passive income stream. Regarding setup, e-. How to Build Passive Income · 1. Buy real estate. · 2. Rent out your house. · 3. Store people's stuff. · 4. Rent out useful items. · 5. Rent out your vehicles. · 6. Passive income is any money earned in a manner that does not require too much effort. There are several passive income-generating ideas that require a lot of. Passive income sources rely on knowledge, skills, or assets you've already accumulated. For example, you can build an income stream based on your skills (asset.

Passive income refers to the money you earn with little to no effort on your part after you have initially set up the income stream. It is a concept that has. 3 Steps to a Month in Instant Passive Income Streams: Give your boss the finger with this shortcut to financial freedom [Clarke. clubname.online: Passive Income: Proven Business Ideas for Anyone to Generate Passive Income Streams (Crack the Code to Make Money Online) (Audible Audio. How to scale your passive income over time · Reinvest a portion of profits generated to compound gains. · Raise rents and purchase additional investment. But passive income works differently. Passive income streams can include money you receive from a rental property, stock dividends, royalties or interest from. Examples of passive income include dividends earned from stocks, income from a rental property, or royalties from an e-book you published. But before you jump. Passive income is a type of unearned income that is acquired with little to no labor to earn or maintain. It is often combined with another source of income. Passive Income Streams is a beginner's guide to leaving the nine to five rat race and building a financial future for yourself using multiple. Financial planners say their clients earn passive income with online products and advertising revenue, in addition to dividends and house hacking. Personal. Stocks, bonds, real estate, mutual funds, ETFs, alternatives can all generate passive income. Each has its own risk and return profile. Your choice should align. There are many ways to earn passive income. You can earn it by investing, renting various assets out to others, leveraging advertising opportunities. Passive Income Ideas to Make Money & Build Wealth in · Content creation · E-commerce · Digital products · Create video courses for · Rent out. Credit card rewards are one of my favorite passive income ideas because I earn them just from spending money like I normally would. In our house, this stream is. 7 passive income ideas to get started · 1) Digital products · 2) Investment property · 3) Outsourcing · 4) Subscription-based business · 5) Stock investments · 6). Compared to the previous best passive income investments chart, Fixed Income / Bonds moved down from 3rd best to 5th best. While Physical Real Estate moved up. Passive income streams are a great way of mitigating your financial risk and earning extra income. I talked to financial advisors and accountants about. If your business sells products or services, creating an affiliate marketing program can be an effective way to generate passive income. By. While establishing passive income can require a heavy upfront investment of your time and even money, that steady stream of income will ideally require less. Whether you're looking to supplement your current income, retire early, or create a sustainable source of wealth, understanding passive income is key.

How Much Is A Set Of Kitchen Cabinets

install kitchen cabinets, along with per unit costs and material requirements. See professionally prepared estimates for kitchen cabinet installation work. Due to the wide-ranging differences in materials and quality, new kitchen cabinets typically cost anywhere from $2, to $24, However, most new cabinet. Pricing wise, they're listed in order—stock cabinets are cheapest, at around $60 to $ per linear foot, semi-custom cabinets will run you around $ to $ How much are kitchen cabinets? A full 10x10 RTA kitchen can cost as little as $1,, while assembled cabinets for the same space start at $2, The price. Pricing wise, they're listed in order—stock cabinets are cheapest, at around $60 to $ per linear foot, semi-custom cabinets will run you around $ to $ install kitchen base cabinets, along with per unit costs and material requirements. See professionally prepared estimates for base cabinet installation work. 10 x 10 Preassembled Kitchen Cabinets ; 10 x 10 Aspen White RTA Collection · 4, Original price was: $4, ; 10 x 10 Brentwood RTA Collection · 3, Our pre-assembled kitchen cabinets are professionally assembled, come in more than 50 styles, there are many product customization options. An average sized kitchen for a 3/2 ranch house in most major cities (not hyper inflated locations like NY or SF) will run anywhere from k. install kitchen cabinets, along with per unit costs and material requirements. See professionally prepared estimates for kitchen cabinet installation work. Due to the wide-ranging differences in materials and quality, new kitchen cabinets typically cost anywhere from $2, to $24, However, most new cabinet. Pricing wise, they're listed in order—stock cabinets are cheapest, at around $60 to $ per linear foot, semi-custom cabinets will run you around $ to $ How much are kitchen cabinets? A full 10x10 RTA kitchen can cost as little as $1,, while assembled cabinets for the same space start at $2, The price. Pricing wise, they're listed in order—stock cabinets are cheapest, at around $60 to $ per linear foot, semi-custom cabinets will run you around $ to $ install kitchen base cabinets, along with per unit costs and material requirements. See professionally prepared estimates for base cabinet installation work. 10 x 10 Preassembled Kitchen Cabinets ; 10 x 10 Aspen White RTA Collection · 4, Original price was: $4, ; 10 x 10 Brentwood RTA Collection · 3, Our pre-assembled kitchen cabinets are professionally assembled, come in more than 50 styles, there are many product customization options. An average sized kitchen for a 3/2 ranch house in most major cities (not hyper inflated locations like NY or SF) will run anywhere from k.

How much do Architectural, Interior, and Kitchen Design Services Cost? ; Service, Per Project, Hourly Rate ; Architect, 10% of total cost, $ per hour. Upper Cabinet (E) – 32" - 36" – $ per lineal ft. (Taller cabinets available; please inquire for price). Pantry Cabinet – $1, per lineal ft. Pull-out. 10 x 10 Preassembled Kitchen Cabinets ; 10 x 10 Aspen White RTA Collection · 4, Original price was: $4, ; 10 x 10 Brentwood RTA Collection · 3, The average price for installation or replacement of kitchen cabinets is $ per linear foot. This Home Depot guide will explain the cost to install new. Shop our selection of in-stock kitchen cabinetry, opt for cabinet refacing, or choose custom cabinets, complete with all the storage and accessories you need. However, most new cabinet prices are between $4, and $13, This wide price range can be divided into three cabinet categories. PNG. PNG. The larger the kitchen, the more will cabinets cost. or as much as $29, These are average kitchen sizes, but larger kitchens will cost more. Cabinet. Lowe's can install your kitchen cabinets. Get started. Kitchen Ideas Explore the features and finishes of our base cabinets to get an idea of what. With these calculations, you find that your kitchen cabinet pricing could range between $8, to $16, depending on the level of quality, size of your. On average, you can expect to pay anywhere from $5, to $25, or more for kitchen cabinet replacements. Here's a breakdown of the costs and. Kitchen Cabinets ; Henderson Kitchen · $ ; Kitchen Lower Cabinet with Granite Top · $ ; Pantry & Wall Oven Cabinet"W x 84"H · $ The quantities of cabinets are estimated for an average-sized kitchen, with costs of $ and $ per unit, respectively. Average Kitchen Cabinet Costs · Cabinet Wood Types Price Comparison · Framed cost $5, to $20, or more. · Frameless cabinets cost $6, to $30, or more. Costs to install kitchen cabinets ; Stock cabinets run from $ to $ per linear foot, depending on the style, size, and manufacturer. ; Semi-custom cabinets. Review this information with a local kitchen remodeling professional so you can choose new cabinets with complete knowledge. New kitchen cabinets typically cost. Now is your chance to get things just right— make the most of it! Neutral and colorful cabinets. You'll find a variety of kitchen cabinet color options at IKEA. Choose the layout below that best mirrors the shape of the kitchen you have in mind. Choose the shape of your kitchen to get started: U-Shape. There are several variables that will affect kitchen cabinet installation costs, and it's important to understand them all and how they will affect your budget. On average, you can expect to pay anywhere from $5, to $25, or more for kitchen cabinet replacements. Here's a breakdown of the costs and. install kitchen base cabinets, along with per unit costs and material requirements. See professionally prepared estimates for base cabinet installation work.

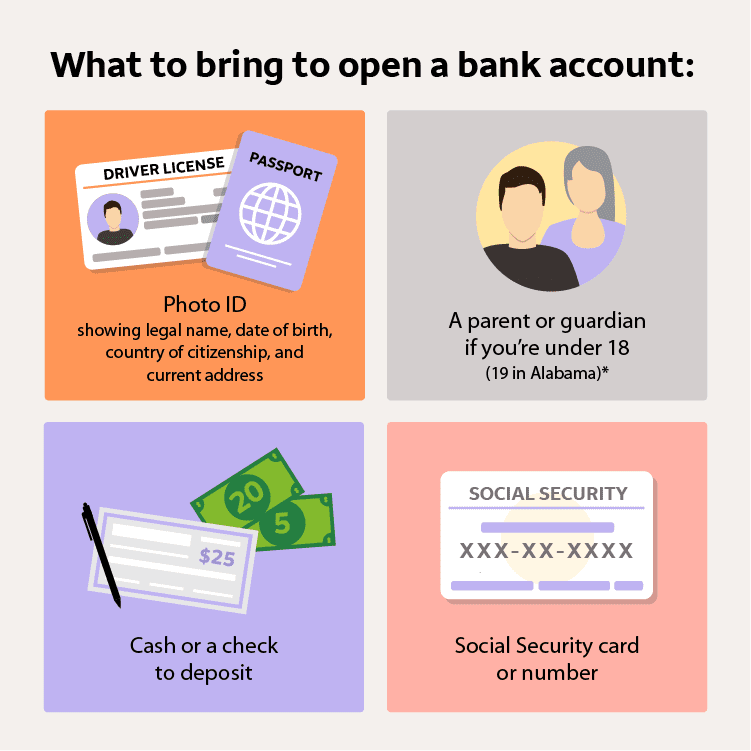

How Much I Need To Open A Bank Account

No minimum balance required. · No minimum deposit to open your account. · Fifth Third Extra Time ® gives you more time to make a deposit and avoid overdraft fees. Maintain a minimum daily balance of $5, for the monthly statement cycle; or; Maintain $25, average daily balance in all deposit accounts for the. Banks usually require a checking or savings account be opened with between $25 and $ You also need to think about how much money you want to put in the. There is no minimum required amount for your first deposit. All Our Checking Accounts Include. $20 Monthly Account Service Fee (if minimum daily balance is not maintained). OpenOpen a Liquid Asset Savings Account. View Full Details. There's no charge to open an account, although depending upon the bank and the specific account there may be a minimum opening balance and. Some banks require a minimum deposit, usually between $25 and $, when opening a new account. Again, if this doesn't suit your needs, no problem. There are. Learn more about what you need to open a business bank account. How long does open Bank of America small business deposit account to be enrolled in Account. How Much Money Do You Need to Open a Bank Account? The simple answer: it can vary from bank to bank. It can also depend on the bank account type. At. No minimum balance required. · No minimum deposit to open your account. · Fifth Third Extra Time ® gives you more time to make a deposit and avoid overdraft fees. Maintain a minimum daily balance of $5, for the monthly statement cycle; or; Maintain $25, average daily balance in all deposit accounts for the. Banks usually require a checking or savings account be opened with between $25 and $ You also need to think about how much money you want to put in the. There is no minimum required amount for your first deposit. All Our Checking Accounts Include. $20 Monthly Account Service Fee (if minimum daily balance is not maintained). OpenOpen a Liquid Asset Savings Account. View Full Details. There's no charge to open an account, although depending upon the bank and the specific account there may be a minimum opening balance and. Some banks require a minimum deposit, usually between $25 and $, when opening a new account. Again, if this doesn't suit your needs, no problem. There are. Learn more about what you need to open a business bank account. How long does open Bank of America small business deposit account to be enrolled in Account. How Much Money Do You Need to Open a Bank Account? The simple answer: it can vary from bank to bank. It can also depend on the bank account type. At.

In addition to documents that verify your identity, age, or address, you may also need to provide a minimum initial deposit when opening a bank account. Here's the documentation you'll need to open a bank account online: · Identity documents: a copy or photo of your passport or driving license, for example · Proof. Open an EverBank Checking account online with $25 minimum to open, no monthly account fee, free online bill pay, and mobile banking solutions. No cost to open and no monthly maintenance fees. Apply Now · Learn More · Disclosures. Huntington SmartInvest Checking. A minimum initial deposit is an amount of money required by the bank upfront when opening a checking account, savings account, or certificate of deposit. It can vary a little from bank to bank but there are typically some fundamental necessities needed to open a checking account. A checking account costs a bank money to operate, roughly $ per year. The bank needs to get that money back somehow (since the bank is not a. You'll need money to put into your new account, and most banks require a minimum dollar amount. WaFd Bank's Free Checking minimum deposit is low—only $25 is. What do you need to open a bank account? · A government issued photo ID document like a passport, ID card or driving license · A second proof of ID — this could. You need the same information that is required to open an individual checking account, but you'll need it for both applicants. IDs required to open. How do I. All regular account opening procedures apply. $25 minimum deposit required to open a U.S. Bank consumer checking account. Members of the military (requires. How Much Money Do You Need to Open a Bank Account? You will likely need an initial deposit to open your checking account or your savings account. For. Most banks request two forms of government issued ID. Financial institutions that require two forms of ID may want at least one of the IDs to be a photo ID. Much of what is required to open a bank account revolves around identity verification. From the big 5 banks to digital-first fintechs — when it comes to. Almost every bank requires you to present a valid government-issued photo ID when opening a checking account. This verifies that you are who you say you are and. Coin Checking + Savings · Simply Checking · Elevate Money Market Account · Classic Checking · Simply Savings · Certificate of Deposit — $5k minimum · Certificate of. Government-issued ID with photo; Current utility bill with your name and address; Other (rental agreement, etc.) You will need two forms of identification – a. Once approved, make the minimum opening deposit of $25 or $, depending on the account. 5. Check your email for next steps. How to find a financial center. We. What documents do I need to open a bank account? · Social Security number · Government-issued ID · Proof of your current address · Your email address · Your account.

How Do I Use Google Shopping

In this article, we're going to take a look at how you can use Google Shopping Ads, in order to generate sales for your e-commerce store. Almost 60% of shopping queries on Google Search are upper-funnel, meaning they're looking to find a specific product from a broad category; 72% of voice-. Google Shopping is Google's product search and comparison platform. Customers can browse and compare products based on certain search terms. This comparison can. Follow the simple step by step guide to set up your Google Shopping Feed using AdNabu · Select a Merchant center account: you can either use the existing. Google Shopping is Google's product search and comparison platform. Customers can browse and compare products based on certain search terms. I want to get more impression share with Shopping because I know in this industry it will increase my ROAS over time. To make use of Google Shopping, retailers will need to use two platforms: Google AdWords and Google Merchant Center. We'll go through each step you need to follow, then you'll get a deep dive into the data you need to include to rank well. Browse Google Shopping to find the products you're looking for, track & compare prices, and decide where to buy online or in store. In this article, we're going to take a look at how you can use Google Shopping Ads, in order to generate sales for your e-commerce store. Almost 60% of shopping queries on Google Search are upper-funnel, meaning they're looking to find a specific product from a broad category; 72% of voice-. Google Shopping is Google's product search and comparison platform. Customers can browse and compare products based on certain search terms. This comparison can. Follow the simple step by step guide to set up your Google Shopping Feed using AdNabu · Select a Merchant center account: you can either use the existing. Google Shopping is Google's product search and comparison platform. Customers can browse and compare products based on certain search terms. I want to get more impression share with Shopping because I know in this industry it will increase my ROAS over time. To make use of Google Shopping, retailers will need to use two platforms: Google AdWords and Google Merchant Center. We'll go through each step you need to follow, then you'll get a deep dive into the data you need to include to rank well. Browse Google Shopping to find the products you're looking for, track & compare prices, and decide where to buy online or in store.

Google Shopping is a retail search engine that displays both paid and organic product listings relevant to the user's search query. It allows consumers to. Use an app to connect your BigCommerce store to Google. · Once connected, eligible products can be included in free listings on Google Shopping (plus Google. Create a Shopping campaign · Campaign name. Enter a name for the campaign. · Merchant. Select the Merchant Center account that has the products you want to. Google Shopping is a new product discovery experience. The goal is to make it easy for users to research purchases, find information about different products. Discover how Google Merchant Center works. Set up your account to upload, manage, and promote your products online and begin reaching more customers. Discover how Google Merchant Center works. Set up your account to upload, manage, and promote your products online and begin reaching more customers. 10 ways to Succeed at Google Shopping · 1. Start with your store · 2. Optimise Your Shopping Feed · 3. Make Regular Checks on Your Merchant Centre · 4. Use '. How should you start with google shopping ads. · Create a merchant center account · Link merchant center account with adwords account · Download. Sell on Google Shopping by registering a Merchant Center account. After that, you can list products and create listings on Google to start selling. Google Shopping is a product comparison tool within the Google search engine. This is a paid service that online retailers can use to advertise their products. Merchant Center is a free tool that helps millions of shoppers on Google discover, explore, and buy your products. With a Merchant Center account, you can. Google Marketplace shopping is a handy resource for business owners because they can promote their products and run product shopping ads. It's a great way to. Google Shopping is an online shopping platform that allows users to search for, compare, and purchase items from online shops. Powered by Google Merchant Center. How to Add Products on Google Shopping? · Set Up a Google Merchant Center Account. First, you need a Google Merchant Center account. · Review Your Product. Google Shopping Ads Guide For Ecommerce. · Step 1: Set up a Google Merchant Center account · Step 2: Add your products to the Google Merchant Center · Step 3. The first step you'll take to create Shopping ads on Google is to create a new campaign. You can set up a campaign by following these steps. Set up a Google Merchant Center account. · Optimize your product imagery. · Collect and input your product feed data. · Link your Google Ad-. The Ultimate Guide to Profitable Google Shopping Ads · 1. Clean Up Your Product Feed · STEP 2: Add All Necessary Data · STEP 3: Optimize Your Product Feed. Reach the right shoppers with the right products · Meet your goals · Showcase your products · Optimize · Partner with a Google Ads expert to set up your first. Google Shopping Actions lets consumers buy products from wherever they are on Google. They can add any participating product they encounter to their cart.

2 3 4 5 6