clubname.online

Overview

What Is A Cryptographic Key

A cryptographic key is a set or sequence of bits or characters that are used as part of an encryption and decryption method. A cryptosystem comprises all the. A cryptographic key is: "[a] value used to control cryptographic operations, such as decryption, encryption, signature generation or signature verification. A parameter used in conjunction with a cryptographic algorithm that determines its operation. Examples applicable to this Standard include: 1. There is a clear division between this and the enterprise model, where you actively manage keys. Key management involves separating keys from data for increased. Asymmetric encryption uses a mathematically related pair of keys for encryption and decryption: a public key and a private key. If the public key is used for. A secret sequence of characters used by a cryptographic algorithm to transform plain text into cipher text or vice versa. At its simplest level, a cryptographic key is just a random string consisting of hundreds or thousands of ones and zeroes (i.e., binary digits, or “bits”). An encryption key is a string of specifically organized bits designed to unscramble and decipher encrypted data. Each key is specific to a specific encryption. A cryptographic key is a piece of information that is used in combination with an algorithm to transform plaintext into ciphertext (encrypted text) or vice. A cryptographic key is a set or sequence of bits or characters that are used as part of an encryption and decryption method. A cryptosystem comprises all the. A cryptographic key is: "[a] value used to control cryptographic operations, such as decryption, encryption, signature generation or signature verification. A parameter used in conjunction with a cryptographic algorithm that determines its operation. Examples applicable to this Standard include: 1. There is a clear division between this and the enterprise model, where you actively manage keys. Key management involves separating keys from data for increased. Asymmetric encryption uses a mathematically related pair of keys for encryption and decryption: a public key and a private key. If the public key is used for. A secret sequence of characters used by a cryptographic algorithm to transform plain text into cipher text or vice versa. At its simplest level, a cryptographic key is just a random string consisting of hundreds or thousands of ones and zeroes (i.e., binary digits, or “bits”). An encryption key is a string of specifically organized bits designed to unscramble and decipher encrypted data. Each key is specific to a specific encryption. A cryptographic key is a piece of information that is used in combination with an algorithm to transform plaintext into ciphertext (encrypted text) or vice.

Inadequate protection of keys. Even keys stored only in server memory could be vulnerable to compromise. Where the value of the data demands it, keys should be. Chain-Key Cryptography. Chain-key cryptography enables subnets of the Internet Computer to jointly hold cryptographic keys, in a way that no small subset of. A crypto wallet consists of two main components: a public key and a private key. The public key serves as the wallet's address, which can be shared with others. In cryptography, a key is a piece of information (a parameter) that determines the functional output of a cryptographic algorithm. For encryption algorithms, a. In cryptography, an encryption key is a variable value that is applied using an algorithm to a string or block of unencrypted text to produce encrypted text. A cryptographic key is a string of characters, such as numbers or letters, which can encrypt and decrypt data when processed through an encryption algorithm. Cryptographic key types A cryptographic key is a string of data that is used to lock or unlock cryptographic functions, including authentication. What is encryption key management? Encryption key management refers to the policies and procedures for generating, distributing, storing, organizing, and. A private key is like a password — a string of letters and numbers — that allows you to access and manage your crypto funds. When you first buy cryptocurrency. Cryptographic key, Secret value used by a computer together with a complex algorithm to encrypt and decrypt messages. Since confidential messages might be. A cryptographic key. In this document, keys generally refer to public key cryptography key pairs used for authentication of users and/or machines (using digital. In general, cryptographic key exchange or encrypted key exchange (EKE) protocols work by allowing the two parties to generate a shared secret. A central enterprise key management system (KMS) provides an overall picture of the key material used in the company. It enables controlled access to encrypted. Encryption key management is the administration of policies and procedures for protecting, storing, organizing, and distributing encryption keys. Encryption. Public key cryptography is a method of encrypting or signing data with two different keys and making one of the keys, the public key, available for anyone to. The definition of cryptographic key refers to a parameter that defines the output of a cryptographic algorithm. A key affects how plaintext is to be. It uses algorithms and mathematical concepts to transform messages into difficult-to-decipher codes through techniques like cryptographic keys and digital. In private key cryptography, the key is used for both encryption and decryption and is shared by all parties that need to operate on the plaintext or ciphertext. A value that determines the output of an encryption algorithm when transforming plain text to ciphertext. The length of the key generally determines how.

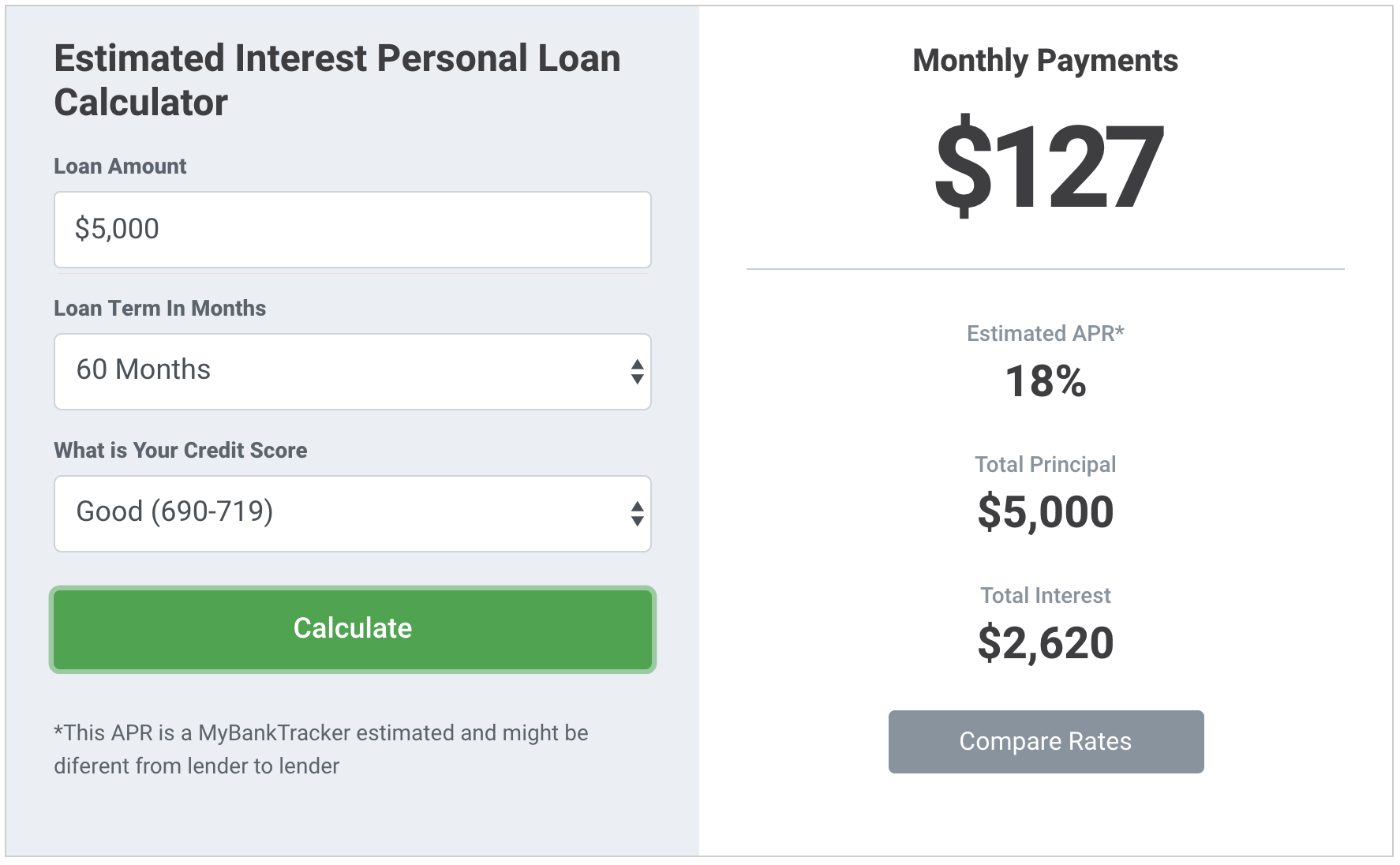

How Much Will My Loan Payment Be Per Month

Then we add up the monthly payment for each of the loans to determine how much you will pay in total each month. The amortization of the loans over time is. Use our calculator to determine your loan payment amount and see how extra payments will We are a living wage employer. Copyright © Meridian Credit Union. A loan calculator can tell you how much you'll pay monthly based on the size of the loan, the loan or mortgage term, and the interest rate. Need to borrow money but aren't sure if you need a loan or line of credit? We'll help guide you, and show you what your monthly payments could be. What is the payment frequency? Select, Weekly, Every 2 weeks, Monthly, Quarterly, Semi-annually, Annuelly. What is the interest rate? Use our auto loan calculator to estimate your monthly car loan payments. Enter a car price and adjust other factors as needed to see how changes affect your. Add your loan details to calculate monthly payments and see the total costs of this loan over time. If you're looking to take out a personal loan but aren't sure how much you can afford to borrow, this personal loan calculator can help you find the answer. Determine your estimated payments for different loan amounts, interest rates and terms with this Simple Loan Calculator. Then we add up the monthly payment for each of the loans to determine how much you will pay in total each month. The amortization of the loans over time is. Use our calculator to determine your loan payment amount and see how extra payments will We are a living wage employer. Copyright © Meridian Credit Union. A loan calculator can tell you how much you'll pay monthly based on the size of the loan, the loan or mortgage term, and the interest rate. Need to borrow money but aren't sure if you need a loan or line of credit? We'll help guide you, and show you what your monthly payments could be. What is the payment frequency? Select, Weekly, Every 2 weeks, Monthly, Quarterly, Semi-annually, Annuelly. What is the interest rate? Use our auto loan calculator to estimate your monthly car loan payments. Enter a car price and adjust other factors as needed to see how changes affect your. Add your loan details to calculate monthly payments and see the total costs of this loan over time. If you're looking to take out a personal loan but aren't sure how much you can afford to borrow, this personal loan calculator can help you find the answer. Determine your estimated payments for different loan amounts, interest rates and terms with this Simple Loan Calculator.

This simple loan calculator can help you see how different interest rates, loan terms and loan amounts can impact a monthly payment. With a Discover personal loan, you can request up to $40, Terms define how long you'll hold the loan and can impact your monthly payment. Be sure you. Say you are making the payments monthly, you would then multiply this by This would bring your interest for the month to $ This calculation is done. will give you a more accurate idea of your potential monthly payment. What is the average interest rate on a loan? How much you'll pay in interest depends on a. Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans. Fixed loan term. Traditional amortization produces a fixed monthly payment. · 2%, % or 1% of balance. Your minimum payment is calculated as a percentage of. The monthly payment is the best indicator of how the car loan will impact your budget. It can give you a reality check on whether you can afford the vehicle. Our loan calculator shows how much a loan will cost you each month and how much interest you will pay overall. It can be helpful to use the calculator to try. You can then use a mortgage calculator or a formula to determine the monthly payment. The formula is: M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1], where M is the. What is the monthly payment on a $5, personal loan? The monthly payment on a $5, loan ranges from $68 to $, depending on the APR and how long the. This Loan Payment Calculator computes an estimate of the size of your monthly loan payments and the annual salary required to manage them without too much. How can I lower my monthly student loan payments without extending the repayment term? You may be able to suspend your student loan payments for a period of. For example, if you know how much you can afford for a monthly payment over a certain number of months and you want to calculate how much money you might afford. Use our simple loan payment calculator to create monthly payment options and picture how they could fit into your budget. Just enter a loan amount, click “. A list of state licenses and disclosures is available here. How to calculate mortgage payments. Zillow's mortgage calculator gives you the opportunity to. how much money you can save by paying off your debt faster. It will also show you how long it will take to pay off the loan at the higher monthly payment. Loan. A higher score can help you secure a better interest rate—which means you'll have a lower monthly car payment. See how your credit score is calculated. Get more. The pay-down or amortization of the loans over time is calculated by deducting the amount of principal from each of your monthly payments from your loan balance. How long will it take to pay off my loan? Use this loan payoff calculator to find out how many payments it will take to pay off a loan. All fields are required. Your lender will use an amortization calculator or software to calculate your monthly payment and prepare the amortization schedule. Doing the math by hand.

All In Mortgage

This loan product isn't for everyone. It's for people who want to tap into their homes equity and at the same time pay down their mortgage. Interest rates can go up and down all they want – your mortgage payments and interest rate hold steady throughout your term. There's more commitment, but. All In Mortgage is a mortgage company that delivers speed, accuracy, & quality to our customers for their loans. Contact us today. Simplicity Insured Mortgage · Simplicity Mortgage · Synergy Variable Rate Convertible Mortgage · Synergy Super Mortgage · Synergy Open Mortgage · Not All Mortgages. Then, enjoy Rewards cash paid straight into your bank account every year. All that paired with competitive rates makes a Servus mortgage the smart choice. Get. all mortgage products. 10/1 ARM. Not everyone plans on living in the same house for Save tens of thousands of dollars and years off your home loan with the All In One Loan, the nation's first transactional offset type-mortgage program. Our Home Buying Center has everything you need to de-stress your next address. Learn about your loan options, the benefits of a Verified Preapproval letter and. All In One is an offset home loan. There's no amortization schedule, interest is calculated nightly based on that days ending balance. Watch the animation below. This loan product isn't for everyone. It's for people who want to tap into their homes equity and at the same time pay down their mortgage. Interest rates can go up and down all they want – your mortgage payments and interest rate hold steady throughout your term. There's more commitment, but. All In Mortgage is a mortgage company that delivers speed, accuracy, & quality to our customers for their loans. Contact us today. Simplicity Insured Mortgage · Simplicity Mortgage · Synergy Variable Rate Convertible Mortgage · Synergy Super Mortgage · Synergy Open Mortgage · Not All Mortgages. Then, enjoy Rewards cash paid straight into your bank account every year. All that paired with competitive rates makes a Servus mortgage the smart choice. Get. all mortgage products. 10/1 ARM. Not everyone plans on living in the same house for Save tens of thousands of dollars and years off your home loan with the All In One Loan, the nation's first transactional offset type-mortgage program. Our Home Buying Center has everything you need to de-stress your next address. Learn about your loan options, the benefits of a Verified Preapproval letter and. All In One is an offset home loan. There's no amortization schedule, interest is calculated nightly based on that days ending balance. Watch the animation below.

The answer is FALSE! After showing clients that interest rates can vary by as much as % between lenders for the same loan. What type of home loan are you looking for? Purchase. Refinance. View all rates Factors that determine your mortgage rate; How to refinance your current. Many factors go into the interest rate you pay. Some factors are part of the cost of all mortgages. Think of a mortgage as. Consolidation is particularly useful for high-interest loans, such as credit cards. Usually, the lender settles all outstanding debt and all creditors are paid. Be aware of callers pretending to be from All In Security asking to verify credit or debit card activity. Call or text us at or visit your. We can tell you the best mortgage rates. Instantly get low rates for everything from 3-year fixed-rate mortgages to 5-year variable-rate mortgages. The California Dream For All Shared Appreciation Loan is a down payment assistance program for first-time homebuyers to be used in conjunction with the. Contact an Alliant mortgage loan officer of your choice with questions about our online mortgage To learn more about mortgages and all stages of homeownership. Save tens of thousands of dollars and years off your home loan with the All In One Loan, the nation's first transactional offset type-mortgage program. All-in-one mortgages allow for the combining of a mortgage and savings. They require the combination of a checking account, home equity loan, and mortgage into. The reverse mortgage for purchase program is designed to help older Americans maintain greater financial flexibility and improved cash flow. This program. Our Home Buying Center has everything you need to de-stress your next address. Learn about your loan options, the benefits of a Verified Preapproval letter and. All Western Mortgage has been built on a solid foundation of trust and sound business practices. We have been committed to serving the needs of our borrowers. USALLIANCE Financial will lend in all states, except for Alaska, Hawaii, and Texas. We do not offer mortgages, home equity loans, or lines of credit on vacant. For credit unions who can not or do not want to retain servicing, our master servicer CUMA (Credit Union Mortgage Association) will service all purchased loans. STEP lets you choose from different kinds of Scotiabank credit products (like mortgages and lines of credit) based on your needs, all with one easy application. A premium may be applied to the rates for all other mortgages. Please visit Mortgage default loan insurance is required by lenders when homebuyers. From purchasing your first home to refinancing your current mortgage, AllSouth Federal Credit Union is here to help. Check rates and apply. Are FHA loans assumable? Most government-backed loans, including all FHA loans, are assumable, as long as the lender approves the sale. However, additional.

Buying First New Car

Contact your insurance company beforehand about adding the new vehicle to your policy. If you're a first-time car buyer, you should be able to purchase auto. How to Buy a New Car · 1. Research Vehicle Types and Market Status · 2. Decide on a Vehicle · 3. Check Your Credit · 4. Set Your Budget · 5. Get Pre-Approved for. Go to your credit union and speak with a loan officer. Once you decide that then do some research online to find cars in your price range, that. If you're short on time, you'll definitely want to fill out our loan application ahead of time. Not only will it give you a better idea of what car you can. 1. Shop pre-owned · 2. Buy a reliable car · 3. Consider ongoing costs of owning a vehicle · Get pre-approved for your first car today. If you plan on visiting a. Once you've determined the magic number for the price you can pay for your new car, then it's time to start shopping. Start by looking online for a car that. What to Do (and What Not to Do) When Buying a New Car From a Dealer · Do: Research Your Purchase · Don't: Go to a Dealership Without Already Having a Financing. New vs. Used vs. Lease Sometimes a new car is the most expensive option, but that spending comes with savings in other areas. For example, you can expect to. Improving your chances of securing an auto loan as a new buyer · Consider a co-signer or co-borrower. Check with your lender to see if they allow having a co-. Contact your insurance company beforehand about adding the new vehicle to your policy. If you're a first-time car buyer, you should be able to purchase auto. How to Buy a New Car · 1. Research Vehicle Types and Market Status · 2. Decide on a Vehicle · 3. Check Your Credit · 4. Set Your Budget · 5. Get Pre-Approved for. Go to your credit union and speak with a loan officer. Once you decide that then do some research online to find cars in your price range, that. If you're short on time, you'll definitely want to fill out our loan application ahead of time. Not only will it give you a better idea of what car you can. 1. Shop pre-owned · 2. Buy a reliable car · 3. Consider ongoing costs of owning a vehicle · Get pre-approved for your first car today. If you plan on visiting a. Once you've determined the magic number for the price you can pay for your new car, then it's time to start shopping. Start by looking online for a car that. What to Do (and What Not to Do) When Buying a New Car From a Dealer · Do: Research Your Purchase · Don't: Go to a Dealership Without Already Having a Financing. New vs. Used vs. Lease Sometimes a new car is the most expensive option, but that spending comes with savings in other areas. For example, you can expect to. Improving your chances of securing an auto loan as a new buyer · Consider a co-signer or co-borrower. Check with your lender to see if they allow having a co-.

Any one of our team members can walk you through the steps to buying a car for the first time and help you determine if you should buy a new vs. used car for. Leave Stress and Hassle in the Rearview. Start your next car search—for a new or used vehicle—with 1st Advantage's Car Buying Service powered by TrueCar. Setting a Budget The first step in buying a new car is setting your budget. Keep it flexible, but always have a maximum price in mind — and make sure you. 3 Things you need to know before buying a new car · 1. Depreciation. Most cars depreciate at about 15% per year. · 2. Cost-to-own. Also, consider the true cost. If it's a new car you're considering, allow a salesperson to do a “walk around” to explain the features and benefits of the car. Feel free to ask the. When buying a new car, start by researching the cars you're interested in and setting your budget. Then compare multiple dealers and cars. New Car Buying Tips · Research first. · Set a budget. · Read the fine print. · Consider shopping online. · Take a test drive. · Beware of ad-ons. · Negotiate the price. Ah, adulthood: an entire world of new possibilities and financial decisions. If you're in the fortunate position of having steady income and a little bit in. Tips for buying your first car · 1. Think about what you need. Yes, you may want that sporty two-door, but is that going to meet your needs? · 2. Go surfing. · 3. Depending on your location, there could be dozens of new or used car dealers within an hour's drive, and hundreds of new or used cars to choose from. Don't. When you pre-qualify first, you will learn exactly how much you can borrow, and therefore how much car you can buy. This will save you the heartache and. First you must choose between buying a new car and buying a used car. A new car may cost more but will come with a longer warranty and no history of abuse or. First time car buyer advice · Choose the car you need and can afford · What are the safest cars for new drivers? · Should you buy a new or used car? · Find a. Michigan First Credit Union provides one-stop shopping through our car-buying service. Find the perfect new or used car without leaving your home. We've outlined some steps, tips and tricks to help you navigate bringing home your new ride. Determine Your Budget The first thing you want to do is determine. Any one of our team members can walk you through the steps to buying a car for the first time and help you determine if you should buy a new vs. used car for. Do your research before heading to a dealership, even if that's not where you plan to obtain financing. Get as much information on the vehicle and selling price. Once you've determined the magic number for the price you can pay for your new car, then it's time to start shopping. Start by looking online for a car that. Today's average new car sells for about $45, - and that's before factoring in taxes, fees, insurance, and other expenses. I know it's boring to talk about.

3 4 5 6 7